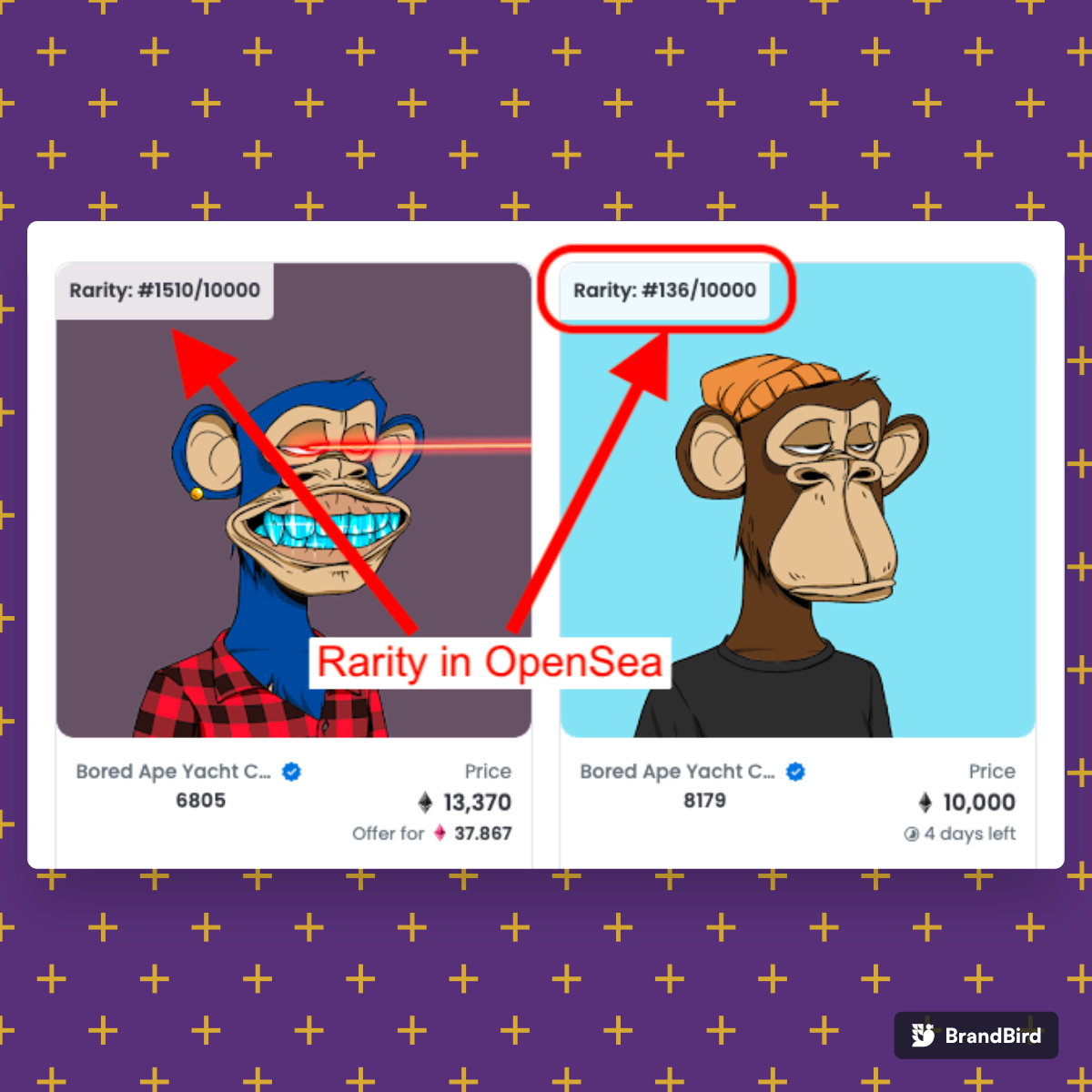

Want rarity ranking directly inside of OpenSea? Download our Extension:

See in chrome web store

See in chrome web storeFinding NFTs before they Explode, 10 repeatable NFT trading strategies and when to use them

12/7/2021 • Nikita Jerschow

One of the most important realizations to make about the NFT market as a trader is to understand that there is a critical difference between trading NFTs versus trading crypto (or stocks).

The difference with NFTs is that the people you are competing with in this market are sill, just people. Sure you might be competing with whales, people with trading bots, and insiders, but you aren't yet competing with banks, hedge funds, algorithms, etc (I call this "big money"). It might not seem that crazy, but think about it this way. All of these entities exist for a reason, to make money. Actually, I'd argue that these entities sole purpose is to make rich people richer.

But, as we all know - there is tons of money to be made in NFTs, so why aren't they apeing in? There are a few reasons

- it's still relatively new and unknown

- they are an absolute nightmare from a legal and tax perspective

- Ethereum gas fees

But the absolute primary reason (I think) is that every single transaction needs to happen through a wallet, and automation is inaccessible short of hiring some (ultra expensive) web3 developers (basically, the dev scene is in its infancy).

A few friends have been telling me to get out of NFTs, and that they will crash soon due to the supply issue. But in my opinion this is the absolute worst time to get out because once the "big money" comes (and they will come) there won't be much left for the rest of us.

The key to success in trading NFTs is to have a robust trading strategy. This is something the average NFT trader does not have, which is why many of them end up in the red. They either trade quickly, wiping out any gains they might make with the gas fees, or HODL, never selling and in most cases riding a dead collection to 0. I find that these are two ends to a spectrum, and the sweet spot is usually the middle.

I personally have fallen into both of these traps, but over time I've discovered a few strategies that work regardless of which direction the market is moving.

What's cool about NFTs is that they are all hype (not all hype, there's utility, gaming use-cases, staking/passive income, etc. but hype and attention is what governs price 90% of the time). This means that a "crash" in the NFT space is less like a crash in broader crypto - where everything falls together, but more like the sneaker space, where a few brands might suffer, but overall the market remains healthy. So knowing what collections people are interested in (and knowing it early) is a massive competitive advantage.

(speaking of which - sneakerheads did/are doing very well in the space)

There is no shortage of cool projects, with celebrity backing, innovating, amazing art in the space. So how do you keep track of them all? and how do you decide where to put your money? Here's what I think:

There are only so many strategies that can realistically work at any given time. And their effectiveness is inversely proportional to how many people:

- Know about them

- Use them

Not all strategies are created equal either, there are strats for when:

- the floor is going up

- the floor is going down

- the floor is going sideways

- Event-based strats

I've compiled a list of all the strats I've encountered and used, with varying degrees of success. I'm sharing them here because there's another bull market coming, and a rising tide lifts all ships.

It goes without saying that you'll make the most money when the market is moving, especially with proper tooling, but there are also tons of strats that help you make the most of a sideways market. Below I'll divide the strats into different sections, and order each strat from most competitive to least competitive.

But first: four things

One: Almost all of these strategies deal with NFT rarity, if you're here I'm assuming you know what that is, but if not, here is a good explainer.

Two: How can I tell if my collection's floor is going up or down? Good question, Opensea offers average price under the activity tab, but this is 1. daily, and 2. not the floor. You can check floor movement with Chilly.tools/nfts

Three: In the various market conditions below, you will see duplicate trading strategy names. Make sure to read through them though, because they mean & function slightly differently in different contexts.

Four: This is not financial advice, always be careful and DYOR. The smartest bets are the ones that look good that you also believe in.

Strats for when market/collection floor is moving up This is likely when you can make the most money, if you are careful.

- (most competitive) Floor hunter - when the floor is rising, you'll often find yourself getting out-gassed for any floor-priced NFTs, unless you have a bot and are ok with spending extra gas, I'd recommend shooting for NFTs 10-20% above floor price, because if floor transactions fail, you're still paying gas fees (yes failed txns still cost gas)

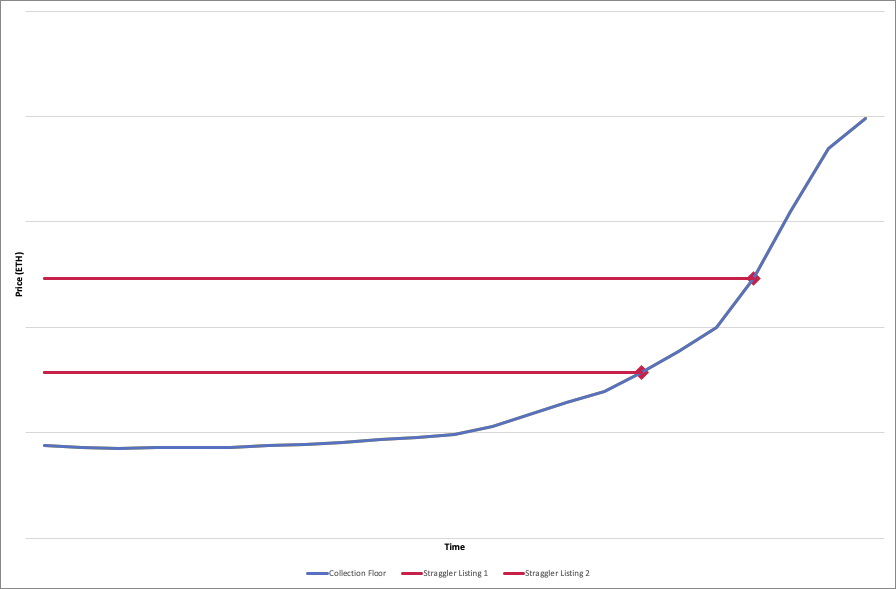

- Straggler sniper - for many collections, especially if the collection has just experienced a sharp drop, people will have listed their NFTs at a certain price which might've been fair relative to rarity at the time of listing, however, as floor goes up, many people end up being slow to update their listing. If you can score a 1 ETH rank 500 on a collection with 0.7 floor, thats a huge win. Here's a graph of rarity vs. price to illustrate what I mean:

- This is a killer strat because it ends up costing gas to cancel and re-create listings to raise prices, which means it's a great opportunity for us to snatch something unfairly cheap.

As you can see in the chart above, if the collection floor price is increasing, and listings are staying at the same price, eventually they will be incredibly cheap compared to what they should be priced at.

As you can see in the chart above, if the collection floor price is increasing, and listings are staying at the same price, eventually they will be incredibly cheap compared to what they should be priced at.

- This is a killer strat because it ends up costing gas to cancel and re-create listings to raise prices, which means it's a great opportunity for us to snatch something unfairly cheap.

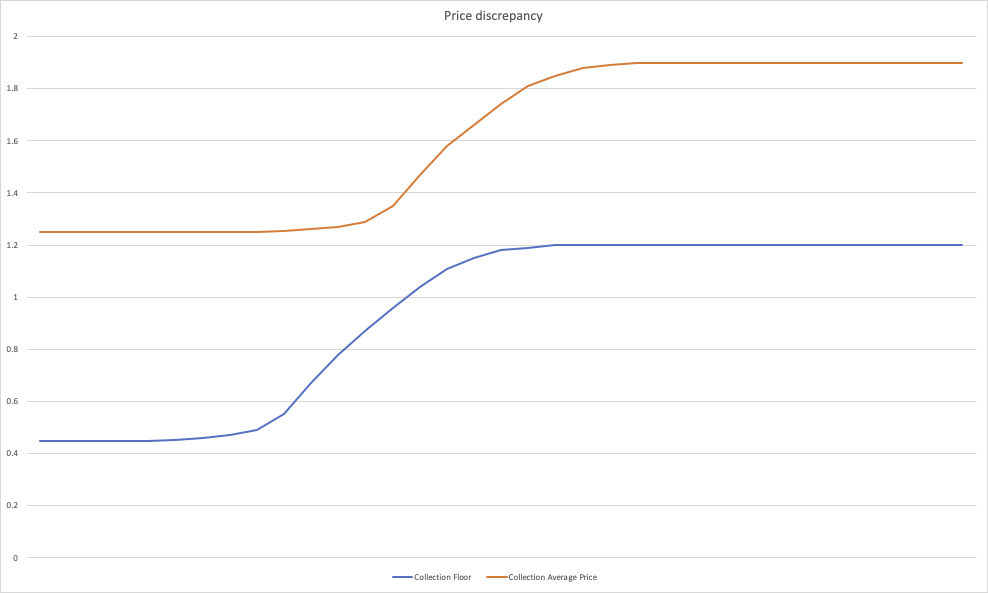

- (least competitive) Arbitrage (avg vs floor) - Arbitrage (or more aptly described as price discrepancy) is very common in the NFT market. There are not enough big players in the market yet to jump on these opportunities before us. There are many different flavors of arbitrage that I've seen work for NFTs, and I'll probably write another post explaining all of those if this post ends up doing well. Avg vs Floor is a discrepancy which is hilariously unutilized. Basically, its common for the floor price of a collection to move, but the average stays roughly the same. Lets explore both possibilities:

- Floor moves up, avg stays same: the more common of the two scenarios. When this happens, any listed NFT that was fair price before the floor movement is now cheaper. In this case, grab up any NFT listed before floor movement that was listed at a fair price among similarly ranked NFTs in terms of rarity, quickly re-list at the new fair market value which you can get by doing (new_floor_price/old_floor_price) * previously_fair_listed_price. Easy flip.

A very common pattern with NFT collections, the floor moves first, and the average lags for a bit. This happens repeatedly as a collection increases in price.

A very common pattern with NFT collections, the floor moves first, and the average lags for a bit. This happens repeatedly as a collection increases in price. - Floor moves down, avg stays same: You need to be careful with this one, the collection may keep falling, personally I wait a few hours before entering into anything with this. In this case, the current floor NFTs are cheap compared to the average, and it would now be a good time to enter at floor, or exit at average, depending on the market condition for the collection.

- Floor moves up, avg stays same: the more common of the two scenarios. When this happens, any listed NFT that was fair price before the floor movement is now cheaper. In this case, grab up any NFT listed before floor movement that was listed at a fair price among similarly ranked NFTs in terms of rarity, quickly re-list at the new fair market value which you can get by doing (new_floor_price/old_floor_price) * previously_fair_listed_price. Easy flip.

NOTE: be sure that there hasn't been some event which is making the market move, this only works in a pure market

Strats for when market/collection floor is dropping Currently, there are no derivatives that let you take advantage of a falling collection (think shorts, put options, etc.) - however, there are still ways to make money on the way down.

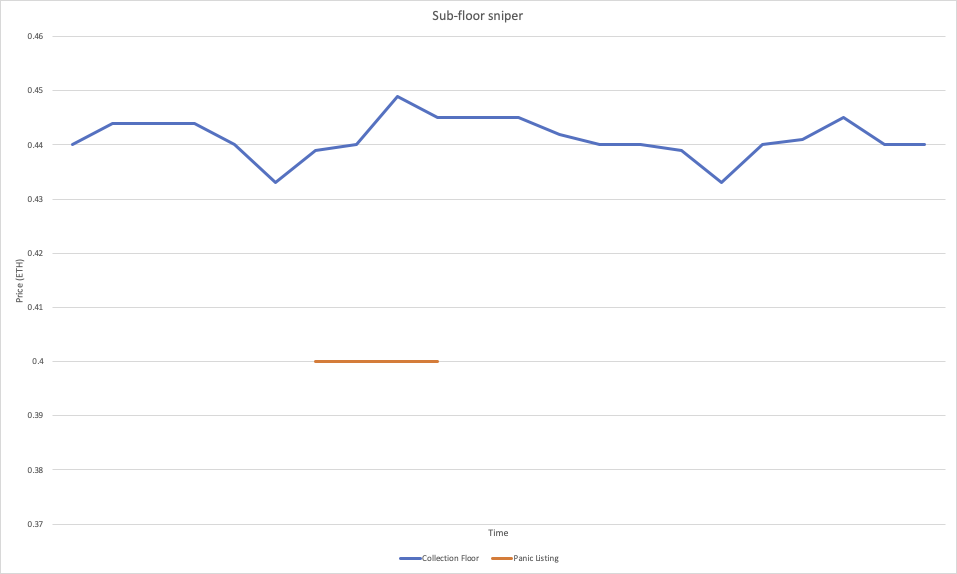

- (most competitive) Floor hunter - It's common for people to panic and list way below floor to get out as soon as possible rather than risking selling for even less. You can take advantage of these by grabbing them up before anyone else gets the chance. Actually chilly.tools has a feature which scans for these every 5 seconds and just pops up the metamask right away.

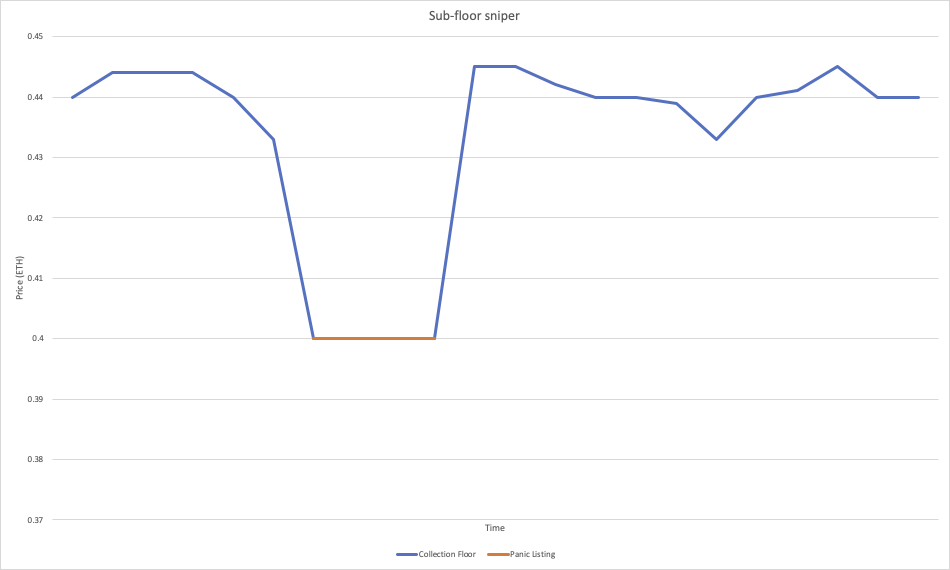

If you are able to grab up the sub-floor listed NFT, you can potentially flip it pretty quickly by re-listing it at floor. Note that the actual collection floor is defined as the lowest listed price of any asset in the collection, so the technically correct graph would look like this:

If you are able to grab up the sub-floor listed NFT, you can potentially flip it pretty quickly by re-listing it at floor. Note that the actual collection floor is defined as the lowest listed price of any asset in the collection, so the technically correct graph would look like this:

- Careful - this is like catching a falling knife, I'd highly recommend knowing why a collection is tanking before using this (exmple: Jungle freaks)

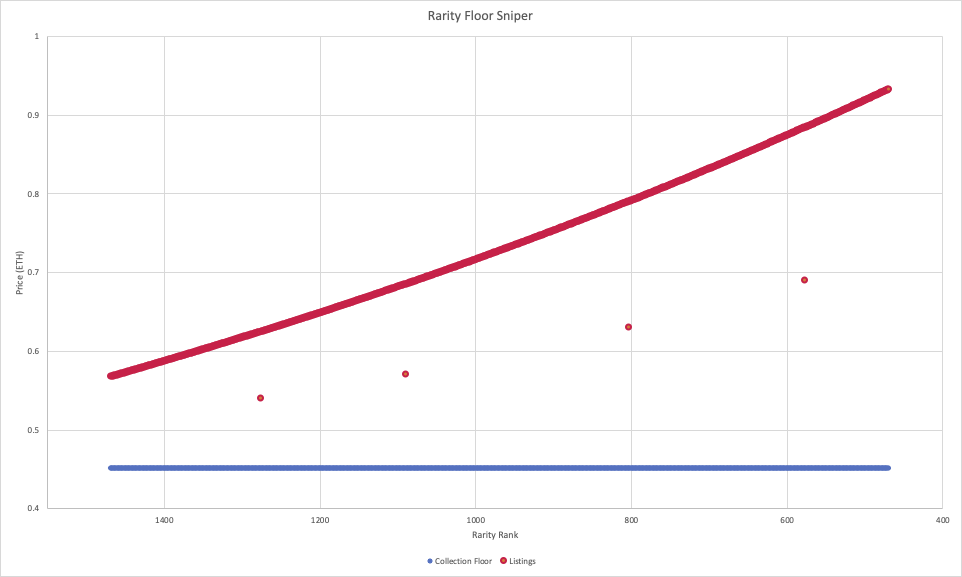

- Rarity floor sniper - this one is less accessible to most people because looking up rarity obviously takes time, and the faster you are able to know the rarity of a specific NFT the more of an advantage you have. This strategy assumes that there is a direct correlation between rarity and the price of an NFT.

- Such a correlation would suggest that only looking at the floor and sniping near it means you are missing 90% of snipes. What we can do instead is estimate the fair market price by looking at NFTs with similar rarity that sold recently, and compensate for any floor change that occurred. By taking the difference between our estimated fair market price and the listing price, we can find out whether this listing is cheaper than what the market things it should be.

- In practice, there ends up being a really strong correlation between rarity and pricing, meaning this is one of the best ways to get ahead of the crowd.

This is a theoretical graph where the relationship between price and rarity is exaggerated to make the point. You can see 4 listings that are technically undervalued, which you could snipe and flip quickly.

This is a theoretical graph where the relationship between price and rarity is exaggerated to make the point. You can see 4 listings that are technically undervalued, which you could snipe and flip quickly.

- paperhands hunter - nervous people reducing price

- You'll often see people listing their NFT lower and lower, as they get more and more nervous that their NFT won't sell. These are often good tokens to put on your watchlist, and maybe make some lowball offers on. It's highly likely that (as long as the NFT doesn't sell to someone else) you'll be able to get a really good deal.

Careful when using these strategies - you'll want to be very confident in your decisions here, because it could be like catching a falling knife. As with anything on this list, be careful and DYOR. You'll want to be very confident in the collection to buy on the way down, and depending on how fast the floor is falling - flipping can be very risky as well.

Strategies for when market/collection floor is flat

- (most competitive) Liquidation hunter (hunt NFTs when someone needs to urgently liquidate)

- Sometimes Holders hear about an opportunity so lucrative and time-sensitive that they need to liquidate their holdings right away, so they'll list their NFT way below floor. This is an amazing chance to scoop up an extremely cheap NFT before anyone else can. Careful - many people watch a collection when the trend is flat, meaning you're likely going to have 2 or 3 people simultaneously trying to scoop this one up. I'd set the gas higher when checking out.

- paperhands hunter - Its common for people to be getting nervous when a collection stays flat for several days, look out for anyone constantly reducing price - it's an easy flip for when volume returns.

EVENT BASED Below is a list of strategies that work when certain events happen in a collection's life-cycle

- mint - this one is somewhat obvious, but when a collection first goes on sale, or "mints", there are a few strategies which are very lucrative

- whitelist - This one is a lot of work, but it is the most surefire way to secure a few cheap tokens out of a collection. Basically, it just involves being a good community member for the NFT collection. So that means: inviting people, being active, saying gm alot, or contributing. I personally don't do this unless I really believe in the team over anything. It's a lot of effort, and other strategies have been more lucrative in my experience.

- mint bot/gas bot - an alternative to whitelisting is to be one of the few who can score an NFT during mint without being on the whitelist. As you can probably imagine, this is incredibly hard to do, and you have to get quite lucky. Many popular collections have 1000 tokens (if not less) available for >200k people. You can increase the odds of securing a token by using a gas bot which will automatically increase gas until the trade goes through. Again, not something I personally do, but has shown great results for others.

- rarity reveal - once a collection mints, its very common for the actual art (and therefore rarity) to be hidden. Meaning that at this point, every token appears the same as any other. However, a collection will then designate a "reveal date" when all art will be revealed at the same time. Typically the collection floor will then pretty quickly diverge: the rarer tokens will be listed for much higher, while the most common tokens will often get listed for half, if not less, of the previous floor price. The two strategies I personally look to take advantage of are:

- (most competitive) mispriced tokens - many tokens will stay listed through the reveal, meaning that there is a chance a super-rare token is listed for near-floor price. This is however almost impossible to take advantage of without a bot, as this can be a pretty easy 1ETH+ flip. Chilly.tools has a bot for this which will pop up the metamask so you can buy as soon as possible. I'd recommend increasing gas for this as well.

- Cheap tokens - its typical for the collection floor to slump shortly after the reveal. If you're bullish about the collection, this is a good time to swipe up a few cheap tokens if you weren't able to during mint. In my experience, the collection floor will reach an absolute minimum anywhere from an hour after reveal, to 2 days after.

All of these strategies will work best during high-volume periods. You want there to be a buyer on the other end.

Remember even with these strategies, this is an arms race. You won't win on every trade, but the goal is to come out expected value positive, ideally while minimizing the analysis you need to do.

As of writing this, floors are rising across the board - it's a good time to enter if you were on the fence.

That's all I have for this post, if this ends up doing well, I'll write another about arbitrage and keep sharing what I learn.

Good luck and WAGMI

-Nikita